Why direct ownership beats syndications every time?

When Real Estate Exists but Investors Still Lose: Two Case Studies Every Canadian Investor Should Understand

Many investors assume losses in real estate only happen when markets crash or properties fail.

Recent enforcement actions show a different reality:

investors can lose money even when real assets exist—if they don’t control them.

Two prominent cases—Marco Santarelli (United States) and Fortress Real Developments (Canada)—illustrate how structure, not property quality, can determine outcomes.

Case Study #1: Marco Santarelli – Control Without Ownership (U.S.)

Marco Santarelli, a well-known real estate educator, was charged by U.S. authorities in connection with an alleged $62.5 million real estate investment fraud.

What Investors Expected

- Professionally managed real estate funds

- Passive income with diversification

- Reduced risk through experience and scale

What Authorities Alleged

- Investor funds were misused and co-mingled

- Returns were misrepresented

- Capital from newer investors was used to meet earlier obligations

- Investors held no direct ownership or decision-making authority over assets

Investor Lesson

Regardless of geography, the risk was structural.

Investors didn’t own property—they owned interests in entities fully controlled by the operator.

📎 Source:

https://www.cbc.ca/news/canada/british-columbia/marco-santarelli-charged-fraud-1.7035634

Case Study #2: Fortress Real Developments – Real Assets, No Investor Control (Canada)

Fortress Real Developments raised over $100 million from Canadian retail investors through syndicated land development and mortgage investment structures.

In 2023, the Ontario Securities Commission concluded that:

- The investments constituted securities

- Material risks were not adequately disclosed

- Investor protections were bypassed

- Investors lacked governance, transparency, and exit control

This occurred despite underlying Canadian real estate assets existing.

Direct investing isn’t about doing everything yourself. It’s about understanding the fundamentals and working with vetted teams who execute transparently while you maintain ownership and decision-making power.

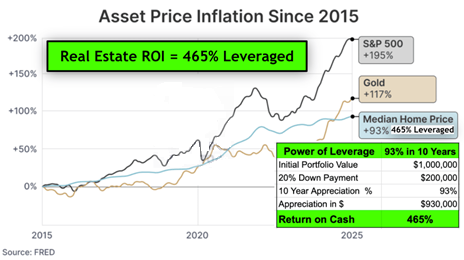

The Power of Leverage with direct Ownership

Investor Lesson

Owning an interest backed by real estate is not the same as owning real estate.

Without legal title or decision rights, investors carried risk without control.

Why This Matters Especially for Canadian Investors

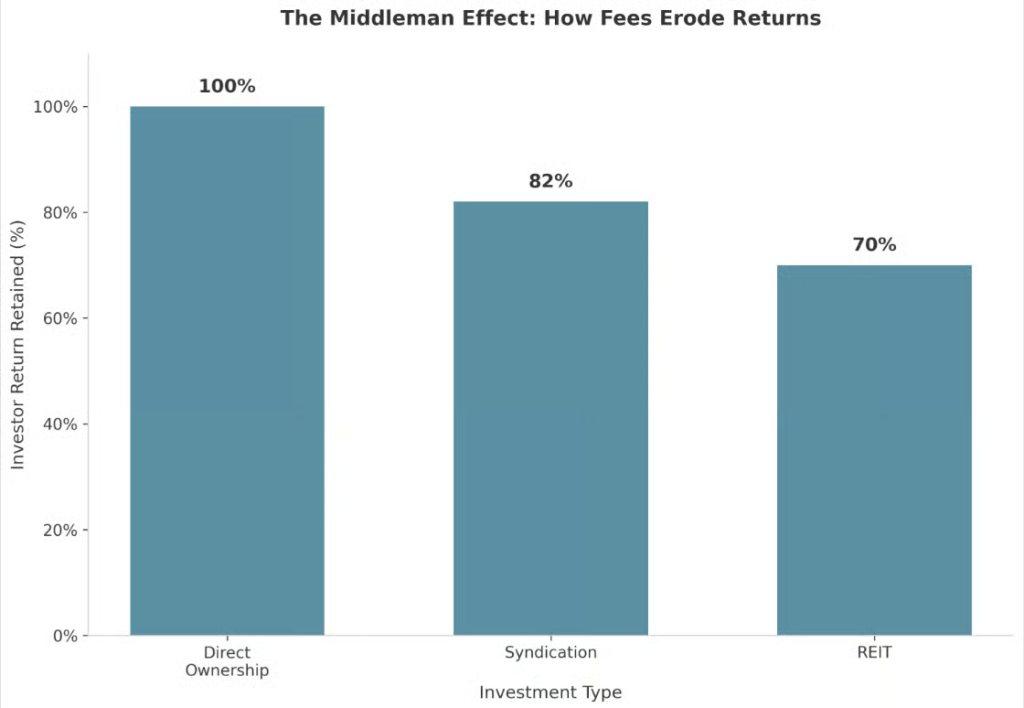

Beyond risk, structure directly impacts after-tax returns.

Tax Limitations in Syndications & Funds (Canada)

- Limited or no access to Capital Cost Allowance (CCA)

- No control over capital gains timing

- No ability to refinance tax-free

- Annual taxable distributions with little flexibility

Tax Advantages of Direct Ownership in Canada

When structured properly, direct property ownership allows:

- CCA to defer taxable income

- Refinancing proceeds that are not taxable income

- Strategic timing of dispositions to manage capital gains

- Greater planning flexibility for incorporated investors

Over time, these factors can improve after-tax returns by 15–25%+ compared to pooled vehicles, where tax control is lost.

The Common Thread in Both Cases

These cases differ in jurisdiction and facts, but share one core issue:

🔴 Investors supplied capital

🔴 Operators retained control

🔴 Investors lacked ownership, transparency, and exit authority

The real estate didn’t fail.

The structure failed the investor.

The Bottom Line

For Canadian investors, wealth preservation and growth depend on more than choosing the “right” market.

They depend on:

- Direct ownership

- Structural transparency

- Control over leverage and exits

- Access to Canada’s real estate tax advantages

At Home Leader Realty, our focus is on helping investors acquire and structure directly owned real estate, using professional teams as executors—not gatekeepers—while the investor retains control.

Control isn’t aggressive.

It’s prudent.

Sources (for reference / disclosure)

Santarelli (CBC – U.S. Case):

https://www.justice.gov/usao-cdca/pr/former-ceo-orange-county-based-private-equity-fund-charged-conning-investors-out-625

Fortress (OSC – Canada):

https://www.fsrao.ca/enforcement-actions/fortress-real-developments-inc-financial-penalty