Experts say Toronto home prices are about to spike again despite lack of sales

It seems that hardly anyone is buying homes in Toronto’s formerly red-hot market anymore, but experts are still predicting that the city’s unshakably high prices are set to surge even higher later this year.

For the first time in far too long, the GTA’s real estate scene is feeling more balanced, with far more inventory than we’re used to, extremely slow sales, and generally less urgency than would-be buyers are used to.

Toronto is overrun with homes for sale that no one is buying because prices are still sky-high.

But, it’s not all sunshine and lollipops for everyone, as developers, realtors and other stakeholders are struggling, and affordability somehow hasn’t improved as one would have expected under the circumstances.

Amid more desperate sellers having to accept lower prices than they’d like as homes sit on the market, and condo projects are being put on ice or even going into receivership, Royal LePage says that these current patterns won’t last long — good news for those on one side of the transaction, but not for the other.

“Sales activity in the GTA was unseasonably slow this spring. New listings are up double digits compared to this time last year, and active listings are the highest they’ve been in more than a decade, ” the firm says in a new market forecast report.

“But despite a marked slowdown in activity, home prices are not trending downward.”

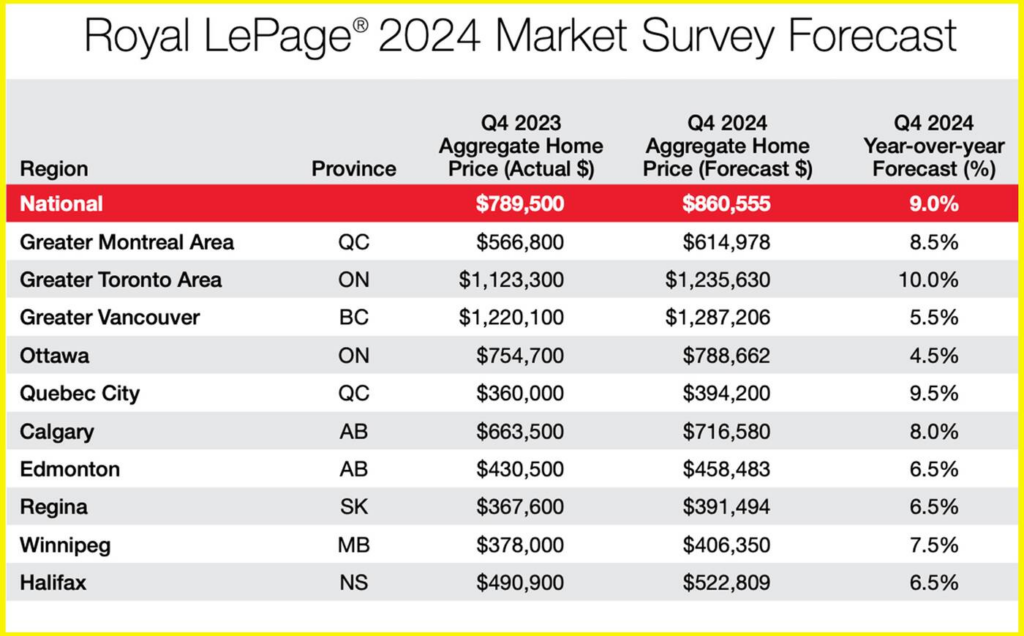

Based on its surveys and stats, and given that there are more rate cuts on the horizon and potentially very pent-up demand, Royal LePage anticipates that the average home price in the region will climb a whopping 10 per cent in the last few months of the year — the most of any major city in Canada — to reach $1,235,630.

Royal LePage’s forecast for Canadian real estate prices in Q4 of this year. Chart from Royal LePage.

Only the far-cheaper Montreal is set to see anywhere near as much of a jump, according to the company, from the $566,800 average in Q4 of last year to an anticipated $614,978 at the same time this year (a difference of 8.5 per cent).

Overall, the report indicates that prices across Canada at all will rise nine per cent by the end of this year (compared to last), reaching $860,555.